बसवनगुडी, बैंगलोर में नवीनतम नौकरी के अवसर और रिक्तियों को कैसे खोजें?

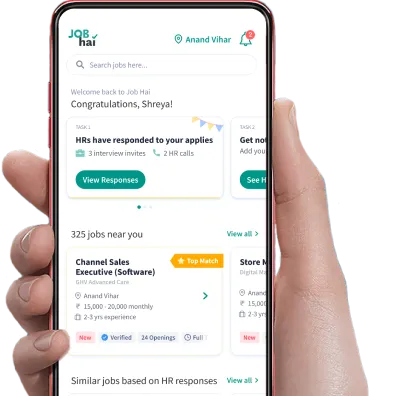

Ans: बसवनगुडी, बैंगलोर में नौकरी की रिक्तियों को Job Hai पर खोजना बहुत आसान है। बस बैंगलोर को स्थान के रूप में और अपना पसंदीदा इलाका बसवनगुडी, बैंगलोर सेट करें और अपनी पसंदीदा श्रेणी का चयन करें।

इस प्रकार आप बसवनगुडी, बैंगलोर में नवीनतम Jobs के लिए आवेदन कर सकते हैं|

आप Job Hai पर बसवनगुडी, बैंगलोर में नौकरियों के लिए किस वेतन की उम्मीद कर सकते हैं?

Ans: Job Hai पर बसवनगुडी, बैंगलोर में 88 सक्रिय नौकरियाँ हैं, जो आपकी इंटरव्यू प्रदर्शन के आधार पर ₹45,000 तक का वेतन प्रदान करती हैं।